Fifth Third Bank

| |

| Fifth Third Bank | |

| Company type | Public |

| Industry | |

| Predecessor | Bank of the Ohio Valley, Third National Bank, Fifth National Bank |

| Founded | June 17, 1858, in Cincinnati, Ohio, U.S. (as Bank of the Ohio Valley) |

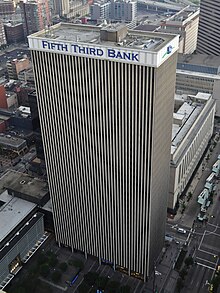

| Headquarters | Fifth Third Center, , U.S. |

Number of locations | 1,088 branches and 2,104 automated teller machines |

Area served | Regional |

Key people | Timothy N. Spence (chairman, CEO and president) Bryan D. Preston (CFO) |

| Products | Consumer banking, corporate banking, private banking, financial analysis, insurance, investment banking, mortgage loans, private equity, wealth management, credit cards |

| Revenue | 5,609,000,000 United States dollar (2022) |

| 3,093,000,000 United States dollar (2022) | |

| Total assets | |

| Total equity | |

Number of employees | 18,724 (December 2023) |

| Website | 53 |

| Footnotes / references [1] | |

Fifth Third Bank (5/3 Bank), the principal subsidiary of Fifth Third Bancorp, is a bank holding company headquartered in Cincinnati, Ohio. Fifth Third operates 1,088 branches and 2,104 automated teller machines, which are in 11 states: Ohio, Florida, Georgia, Illinois, Indiana, Kentucky, Michigan, North Carolina, South Carolina, Tennessee, and West Virginia.[1] It is on the list of largest banks in the United States and is ranked 321st on the Fortune 500.[2] The name "Fifth Third" is derived from the names of the bank's two predecessor companies, Third National Bank and Fifth National Bank, which merged in 1909.

History

[edit]Pre-merger (1858-1908)

[edit]On June 17, 1858, the Bank of the Ohio Valley, founded by William W. Scarborough, opened in Cincinnati, Ohio. On June 23, 1863, the Third National Bank was organized. On April 29, 1871, Third National Bank acquired Bank of the Ohio Valley. In 1888, Queen City National Bank changed its name to Fifth National Bank.[3]

Merger of Third National Bank and Fifth National Bank (1908)

[edit]On June 1, 1908, Third National Bank and Fifth National Bank merged to become the Fifth–Third National Bank of Cincinnati; the hyphen was later dropped. The merger took place when prohibitionist ideas were gaining popularity, and it is a legend that "Fifth Third" was better than "Third Fifth", which could have been construed as a reference to three fifths of alcohol.[4] The name went through several changes—the most recent being Fifth Third Union Trust Company[5]—until March 24, 1969, when it was changed to Fifth Third Bank.

Post-merger

[edit]In 1999, the bank acquired Emerald Financial for $204 million.[6]

In November 2008, the United States Department of the Treasury invested $3.4 billion in the company as part of the Troubled Asset Relief Program and in February 2011, the company repurchased the investment from the Treasury.[7][8]

In 2009, Fifth Third completed the corporate spin-off of Fifth Third Processing Solutions, which was acquired by Worldpay, Inc. in 2012.[9]

In May 2018, Fifth Third acquired MB Financial in a $4.7 billion transaction.[10]

In August 2020, the bank signed a partnership with Trust & Will.[11]

In May 2022, Fifth Third acquired Dividend Finance, a San Francisco–based residential solar power lender.[12][13]

In May 2023, the bank acquired Rize Money.[14] Also in May 2023, the bank acquired Big Data Healthcare.[15]

Lawsuits

[edit]In December 2016, small business owners sued Fifth Third, along with Vantiv and National Processing Company, for violating telemarketing laws. On August 4, 2022, a $50 million settlement was finalized.[16]

On March 9, 2020, the Consumer Financial Protection Bureau (CFPB) charged Fifth Third with illegal cross–selling; the suit was resolved in 2024 with the bank paying $20 million and taking remedial actions.[17] A class action suit was filed on behalf of former MB Financial shareholders, alleging that the cross–selling strategy artificially inflated Fifth Third's stock price and thus MB Financial's shareholders were not honestly compensated when the purchase occurred. The case was settled on September 14, 2023, with Fifth Third paying former MB Financial shareholders $5.5 million.[18]

In September 2015, the US Department of Justice and the Consumer Financial Protection Bureau announced an $18 million settlement to resolve allegations that Fifth Third Bank engaged in a pattern or practice of discrimination against African–American and Hispanic borrowers in its indirect auto lending business.[19]

On April 27, 2023, a jury sided with Fifth Third in a lawsuit filed by customers of its Early Access loan program. The program charged a 10% flat fee. While Fifth Third listed an APR estimate of 120%, the actual APR would be higher if the loan was paid off early due to the fee structure. While the jury agreed Fifth Third breached its loan agreement, it also agreed that customers were fully aware of the fee and thus were not awarded any damages.[20]

On March 8, 2024, the Minnesota Attorney General filed suit against Fifth Third subsidiary Dividend Finance and three other lending companies (GoodLeap, Sunlight Financial, and Solar Mosaic), following an investigation that uncovered they charged Minnesotans $35 million in hidden fees on nearly 5,000 loans to finance sales of residential solar panels. The lawsuit alleges the lenders violated Minnesota state laws against deceptive trade practices, deceptive lending, and illegally high rates of interest.[21][22][23]

Notable corporate buildings

[edit]- Fifth Third Center in Grand Rapids, Michigan

- Fifth Third Center in Charlotte, North Carolina

- Fifth Third Center in Cincinnati, Ohio

- Fifth Third Center in Cleveland, Ohio

- Fifth Third Center in Columbus, Ohio

- Fifth Third Center at One SeaGate in Toledo, Ohio

- Fifth Third Center in Dayton, Ohio

- Fifth Third Center in Nashville, Tennessee

- Fifth Third Center in Tampa, Florida

Naming rights and sponsorships

[edit]Fifth Third owns corporate naming rights to the following:

- Fifth Third Field, a ballpark in Toledo, Ohio, home of the Toledo Mud Hens, the Triple-A minor league baseball Affiliate of the Detroit Tigers.

- Fifth Third Arena, an indoor arena on the campus of the University of Cincinnati, home of the Cincinnati Bearcats Athletics.

- Fifth Third Arena, an indoor arena in Chicago, Illinois, practice facility and Community Ice Rink of the Chicago Blackhawks.

- Fifth Third Bank Stadium, a football stadium in Kennesaw, Georgia, home of the Kennesaw State Owls Athletics.

- Fifth Third Park, an under–construction ballpark in Spartanburg, South Carolina, future home of the Down East Wood Ducks the Single-A minor league baseball Affiliate of the Texas Rangers.

Fifth Third Bank is a sponsor of the following:

- Cincinnati Bengals – Official Bank of the Cincinnati Bengals.

- Chicago Blackhawks – Official Partner of the Chicago Blackhawks.

- Tampa Bay Buccaneers – Official Bank of the Tampa Bay Buccaneers.

- Los Angeles Lakers – Official Partner of the Los Angeles Lakers.

- Kennesaw State University – Official Bank of the Kennesaw State Athletics.

- University of Cincinnati – Official Partner of the University of Cincinnati.

- University of Dayton – Official Bank of the University of Dayton.

- Toledo Mud Hens – Official Bank of the Toledo Mud Hens.

- Columbus Zoo – Official Bank of the Columbus Zoo.

- Gary SouthShore RailCats – Official Bank of the Gary SouthShore RailCats.

- RFK Racing – Primary Sponsor of the No. 17 Ford Mustang GT for Chris Buescher in the NASCAR Cup Series.

- Rahal Letterman Lanigan Racing – Official Sponsor of the No. 15 Honda for Graham Rahal in the NTT IndyCar Series.[24]

- Spartanburg Baseball Club[25]

See also

[edit]References

[edit]- ^ a b "Fifth Third Bancorp 2022 Annual Report (Form 10-K)". U.S. Securities and Exchange Commission. February 27, 2024.

- ^ "Fifth Third Bancorp". Fortune.

- ^ "Fifth Third Bank Celebrates 165 Years of Service, Innovation, Impact". Columbus Chamber of Commerce. June 22, 2023.

- ^ "Organization: Fifth Third Bank". Cbonds. Retrieved May 1, 2024.

- ^ Brickey, Homer (April 2, 2002). "That funny name for a bank has grown on us". The Blade.

- ^ "Fifth Third to acquire Emerald Financial; become Ohio's". March 1, 1999.

- ^ Protess, Ben (February 2, 2011). "Fifth Third Repays Bailout Funds". The New York Times.

- ^ "Fifth Third Bancorp repays TARP debt". American City Business Journals. February 2, 2011.

- ^ "Welcome to the new Worldpay". Worldpay, Inc.

- ^ Coolidge, Alexander (May 21, 2018). "Fifth Third spends $4.7 billion for Chicago's MB Financial". USA TODAY. Cincinnati Enquirer.

- ^ "Fifth Third Bank and Trust & Will Announce Strategic Relationship to Help Customers Protect and Secure Their Families'". Bloomberg News. July 16, 2020.

- ^ Castroverde, Jasmine (May 11, 2022). "Fifth Third Bancorp completes acquisition of Dividend Finance". S&P Global.

- ^ "Fifth Third Completes Acquisition of Dividend Finance, Leading Lender in High Growth Solar, Sustainable Solutions" (Press release). Business Wire. May 10, 2022.

- ^ Stutts, Jordan (May 22, 2023). "Fifth Third targets payments expansion with Rize Money acquisition". American Banker.

- ^ "Fifth Third Bank completes acquisition of Big Data Healthcare". American City Business Journals. May 16, 2023.

- ^ Holland, Scott (August 10, 2022). "Judge finalizes $50M settlement with Fifth Third, Vantiv over recorded telemarketing calls". Cook County Record.

- ^ "CFPB Takes Action Against Fifth Third for Wrongfully Triggering Auto Repossessions and Opening Fake Bank Accounts". Consumer Financial Protection Bureau. July 9, 2024.

- ^ "Fox v. Fifth Third Bancorp". Retrieved March 1, 2024.

- ^ "Justice Department and Consumer Financial Protection Bureau Reach Settlement to Resolve Allegations of Auto Lending Discrimination by Fifth Third Bank". United States Department of Justice. September 28, 2015.

- ^ Monk, Dan (April 28, 2023). "Federal jury awards zero damages in Fifth Third loan case". WCPO.

- ^ "Attorney General Ellison sues solar lenders over $35M in deceptive hidden fees" (Press release). Office of the Attorney General of Minnesota. March 8, 2024. Archived from the original on May 20, 2024. Retrieved May 27, 2024.

- ^ Office of the Attorney General of Minnesota (April 5, 2024). "Minnesota v. GoodLeap LLC, Sunlight Financial LLC, Solar Mosaic LLC, and Dividend Solar Finance LLC" (PDF). US District Court for the District of Minnesota. Archived (PDF) from the original on May 27, 2024. Retrieved May 27, 2024.

- ^ Weaver, John Fitzgerald (April 26, 2024). "Minnesota sues GoodLeap, Sunlight, Mosaic and Dividend over dealer fees". PV Magazine. Archived from the original on April 30, 2024. Retrieved May 27, 2024.

- ^ "Fifth Third Bank Extends Sponsorship of RLL through 2025". Indycar.com. August 7, 2022. Retrieved March 27, 2023.

- ^ "Fifth Third Bank lands naming rights to new stadium, tennis". American City Business Journals. April 4, 2024.

External links

[edit]- Official website

- Business data for Fifth Third Bank:

- Companies in the NASDAQ Financial-100

- Companies listed on the Nasdaq

- 1858 establishments in Ohio

- American companies established in 1858

- Banks based in Ohio

- Banks established in 1858

- Companies based in Cincinnati

- Economy of the Midwestern United States

- Economy of the Southeastern United States

- Investment banks in the United States

- Mortgage lenders of the United States

- Online brokerages

- Primary dealers

- Rogue trading banks

- Subprime mortgage lenders

- Systemically important financial institutions